Why Asset Manager Canaccord Says Tesla Stock Will Explode by 40% in 2019

发布时间:2019-02-13 15:20:52 发布人:TokenString

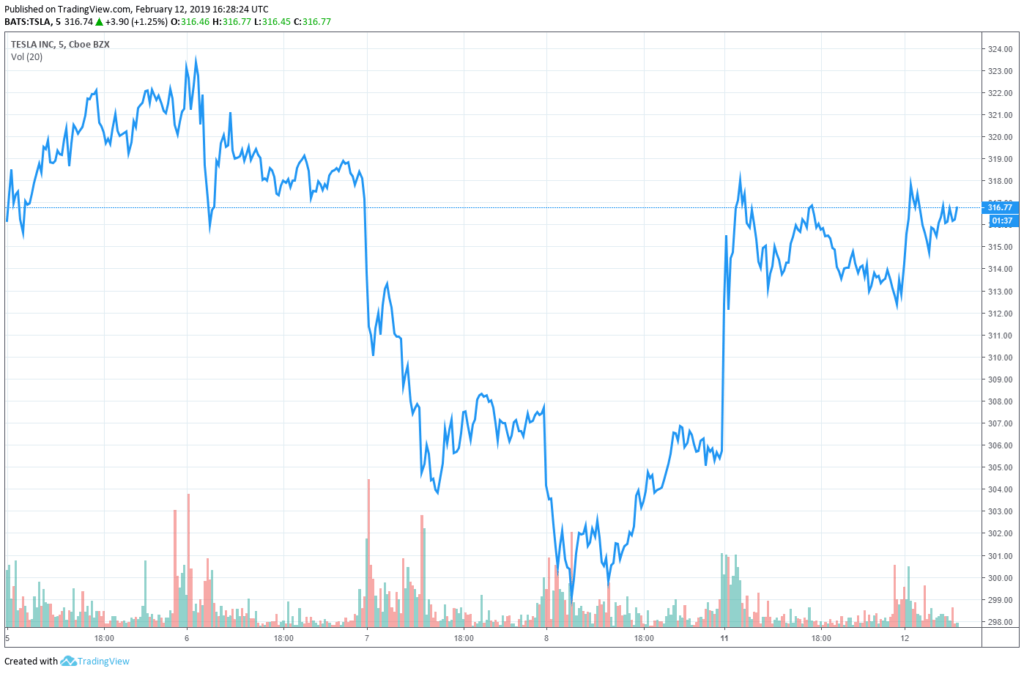

Despite a wider recovery in the US stock market, Tesla’s new year got off to a rocky start. The company’s stock plummeted, particularly after RBC Capital gave the electric vehicle maker’s shares a dreaded “sell” rating.

Striking at the core of the matter, RBC Capital analyst Joseph Spak said:

“It’s not that we don’t believe Tesla can grow over time, our model shows solid LT growth. But the current valuation already considers overly lofty expectations.”

The analyst also credited Tesla for providing investors clarity on its production plans, but he said this move puts pressure on growth expectations, which makes it difficult to “justify current levels, let alone to add to positions.”

WHY TESLA STOCK WILL RALLY 40% IN 2019

Less than one month later, another wealth manager is forecasting a much rosier outlook for Elon Musk and company, and investors are listening.

As first reported by CNBC, Canaccord Genuity has upgraded Tesla from hold to buy, predicting a 40 percent rally for the stock in 2019 based on the growth potentials of the electric vehicle market they believe is currently “underappreciated.”

Canaccord analyst Jed Dorsheimer told clients on Monday:

“We view the recent string of price cuts as further proof that the cost-cutting and right-sizing that the company has undertaken are resulting in concrete movement towards the ultimate goal of an affordable $35,000 Model 3.”

Tesla has been making smart choices on the road to making this goal a reality. It recently purchased California-based battery maker Maxwell Technologies, dumping longtime business partner Panasonic on the curb. It ended thecustomer referral program and slashed the price of its Model 3 by $1,100, which now costs $43,000 before credits and fuel savings.

Model 3 starting cost now ~$35k (after ~$8k of credits & fuel savings) https://t.co/46TXqRrsdr

— Elon Musk (@elonmusk) February 6, 2019

The Silicon Valley automaker further won the approval to start shipping its Model 3 to Europe last month.

Spotted awesome

Despite a wider recovery in the US stock market, Tesla’s new year got off to a rocky start. The company’s stock plummeted, particularly after RBC Capital gave the electric vehicle maker’s shares a dreaded “sell” rating.

Striking at the core of the matter, RBC Capital analyst Joseph Spak said:

“It’s not that we don’t believe Tesla can grow over time, our model shows solid LT growth. But the current valuation already considers overly lofty expectations.”

The analyst also credited Tesla for providing investors clarity on its production plans, but he said this move puts pressure on growth expectations, which makes it difficult to “justify current levels, let alone to add to positions.”

WHY TESLA STOCK WILL RALLY 40% IN 2019

Less than one month later, another wealth manager is forecasting a much rosier outlook for Elon Musk and company, and investors are listening.

As first reported by CNBC, Canaccord Genuity has upgraded Tesla from hold to buy, predicting a 40 percent rally for the stock in 2019 based on the growth potentials of the electric vehicle market they believe is currently “underappreciated.”

Canaccord analyst Jed Dorsheimer told clients on Monday:

“We view the recent string of price cuts as further proof that the cost-cutting and right-sizing that the company has undertaken are resulting in concrete movement towards the ultimate goal of an affordable $35,000 Model 3.”

Tesla has been making smart choices on the road to making this goal a reality. It recently purchased California-based battery maker Maxwell Technologies, dumping longtime business partner Panasonic on the curb. It ended thecustomer referral program and slashed the price of its Model 3 by $1,100, which now costs $43,000 before credits and fuel savings.

Model 3 starting cost now ~$35k (after ~$8k of credits & fuel savings) https://t.co/46TXqRrsdr

— Elon Musk (@elonmusk) February 6, 2019

The Silicon Valley automaker further won the approval to start shipping its Model 3 to Europe last month.

Spotted awesome